We all marvel at how the elite create wealth exponentially. How do they do it?

Pay close attention! This is one of their secrets!

Crunchbase.com

Amazon Acquisitions

In 1994, Jeff held 60 meetings with family members, friends and prospective investors to get them to each invest around $50,000 apiece in Amazon and help him raise $1 million. Only 20 said yes, a group which included his parents.

The investment was far from a sure bet. Jeff was clear there was a 70 percent chance his parents wouldn't see that money ever again.

He told them, "I want to come home at dinner for Thanksgiving and I don't want you to be mad at me."

His parents weren't convinced he should leave his "sweet job on Wall Street" — what Mike would later call the vice president role Jeff had worked up to at hedge fund D. E. Shaw.

"Don't quit your job," his mother warned. She asked him, "Can you do this on the weekends and nights?"

Running an e-commerce business when most people didn't have computers was its own gamble. In the 1990s, the web was used by government agencies and universities — not consumers. Mike reportedly asked his stepson, "What's the internet?"

Though his parents studied Jeff's business plan, they still did not fully grasp what their son had in mind. "All of that went over our heads to a large extent," Mike was quoted in the book "The Everything Store." "As corny as it sounds, we were betting on Jeff."

The couple would invest nearly five times Jeff's ask. By mid-1999, Bezos' net worth was already over $9 billion and his parents had become billionaires as well.”

Quora.com

Read the whole story here

Mark Zuckerberg and the Meta offering

Business brokerage sites:

Bizbuysell.com

Flippa.com

Loopnet.com

Franchisedirect.com

More on Jeff Besos

How Jeff Bezos Found Risky Startup Capital For Amazon

Alan Grosheider

By now, everyone knows that Jeff Bezos started Amazon and went on to become the richest man in the world (now the second richest). But do you know how he funded the early stages of Amazon? I've raised capital for early-stage companies a few times, so I'm always interested in how successful companies made it happen at the very beginning.

Some companies can get started with very little funding. A very rare few can bootstrap their way to billions. However, a lot of companies, like Amazon, need enough capital to build their product, prove their concept, and gain momentum.

In 1994, Bezos started with nothing but a plan to capitalize on the burgeoning potential of the Internet. He invested $10,000 from his personal savings to incorporate a company called Cadabra, Inc. Eventually, he changed the name to Amazon after one of his attorneys misheard the name as Cadaver. Then came his most risky investment. His parents invested $250,000, a significant portion of their savings. This is the most risky money you can get. If you lose your own money, you can get over it. If you lose money from wealthy investors, they can get over it. If you lose your parents' retirement money, you have to think about that for the rest of your life. He even told them that he had a 70% chance of failing.

After about a year of development and beta testing, the website went live. Then, according to Richard Brandt's book about Amazon, "One Click," additional startup capital for Amazon was acquired through good old-fashioned networking during 1995 and 1996.

Brandt states that "[a] Seattle-based stock broker named Eric Dillon was interested in investing but thought the valuation Bezos had put on the company—$6 million—was pulled out of thin air, until Bezos sat down with him to show how much other Internet companies were trying to raise. Dillon talked Bezos down to a $5 million valuation and put in some money. A Seattle businessman named Tom Alberg was impressed with Bezos's projection that Amazon could turn over the equivalent of an average bookstore's inventory 20 times a year, compared with 2.7 times for most bookstores—with details to back up the claim."

He continues, "In the end, [Nick] Hanauer managed to get some commitments by making the first investment himself. Others followed, and by the end of the year, another twenty investors kicked in money, most of them around $30,000 apiece. Bezos raised $981,000."

In June of 1996, Amazon raised an $8 million Series A round from Kleiner Perkins. This investment and strategic partnership allowed Amazon to grow all the way to an IPO in 1997. The IPO raised $54 million for Amazon, giving the company a market value of $438 million. After that, the company plowed everything back into growth for years, producing a staggering 178,000% increase since that time.

Of course, the story of Amazon is a very rare exception. Not too many people can obtain $250,000 from their parents. Not many companies can raise an $8 million Series A after one year of operation. And very few companies go public with only $9 million invested and two years of operation.

It's estimated that 90% of startups fail. Even venture-backed startups fail 75% of the time. It's even more likely that a startup never gets off the ground at all. Lots of people have ideas, and they're never able to raise the capital required to try them out. Even Amazon would not be here today without the risks taken by Jeff Bezos's parents and the 20 or so brave angel investors.

#leadership #innovation #technology #jeffbezos #amazon

What was the secret to Jeff Besos exponential growth?

- Opinion from GetMentors.AI Click here

- Jeff Besos on having too many good ideas -In Amazon’s early days, Jeff Bezos had an endless stream of ideas. One day, executive Jeff Wilke gave him a hard truth: “Jeff, you have enough ideas to destroy Amazon.” That moment changed everything. Bezos realized that innovation without focus leads to chaos.

Too many ideas at once slowed execution, scattered attention, and drained resources. From then on, he became intentional about timing, holding back new initiatives until the company and its teams were ready.

That discipline helped Amazon scale intelligently—staying inventive without losing operational precision. It’s what turned the chaos of creativity into a system for long-term success.

Follow us (@simplyougrow) for everything related to entrepreneursMedia: Reuters https://www.instagram.com/reel/DPgTraYFbDa/

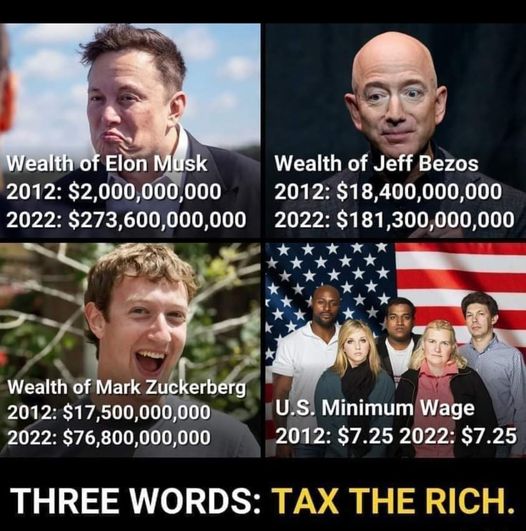

Elon Musk

ARE MAGA’S FORGETTING THAT ELON MUSK WAS ON THE VERGE OF BANKRUPTCY WHEN HE BEGGED THE OBAMA ADMINISTRATION FOR AN UNUSUAL FINANCIAL BAILOUT. It became a brand new federal loan program. The “Advanced Technology Vehicle Manufacturing loan program“ provided Tesla with $465 million just six months before the company went public.

Early fund raising ideas: Thoughts from Chris Poff-Creator of Wizard Brain Trust

Every business needs to understand their funding options as they relate to their current situation. Creating a funding plan is critical for a business start up or small business that wants to quantum leap to the next level of income and lifestyle.This will need revised over time as your business scales up. A funding plan for a start up is vastly different than a mature business that is highly profitable. Each plan is different and must be tailored to the individual company and owner at any given time. That is where the custom tailored funding plan is critical. The challenge for most small business owners is that they were never taught even the basics of credit, obtaining funding, and managing cash flow and profitability. Contact me now to learn how you can create your own funding plan for exponential growth.

HOW THE ELITE CREATE GENERATIONAL WEALTH

Was this a helpful overview?

Experience the results yourself!

Reach out to me by email at christopherpoff@gmail.com or call/text me at 407-908-8023 and we'll initiate the QUANTUM LEAPING PLAN FOR YOUR LIFESTYLE!